The current 2023 Edelman Trust Barometer – Insights for Financial Services shows that trust in the German financial sector is not good. Out of 17 industries, people worldwide trust companies from the financial sector the second least. Only companies from the social media sector are trusted less. Just 40% of respondents in Germany say they trust companies from the financial services sector – a vote of no confidence that is lower than the global average (59%).

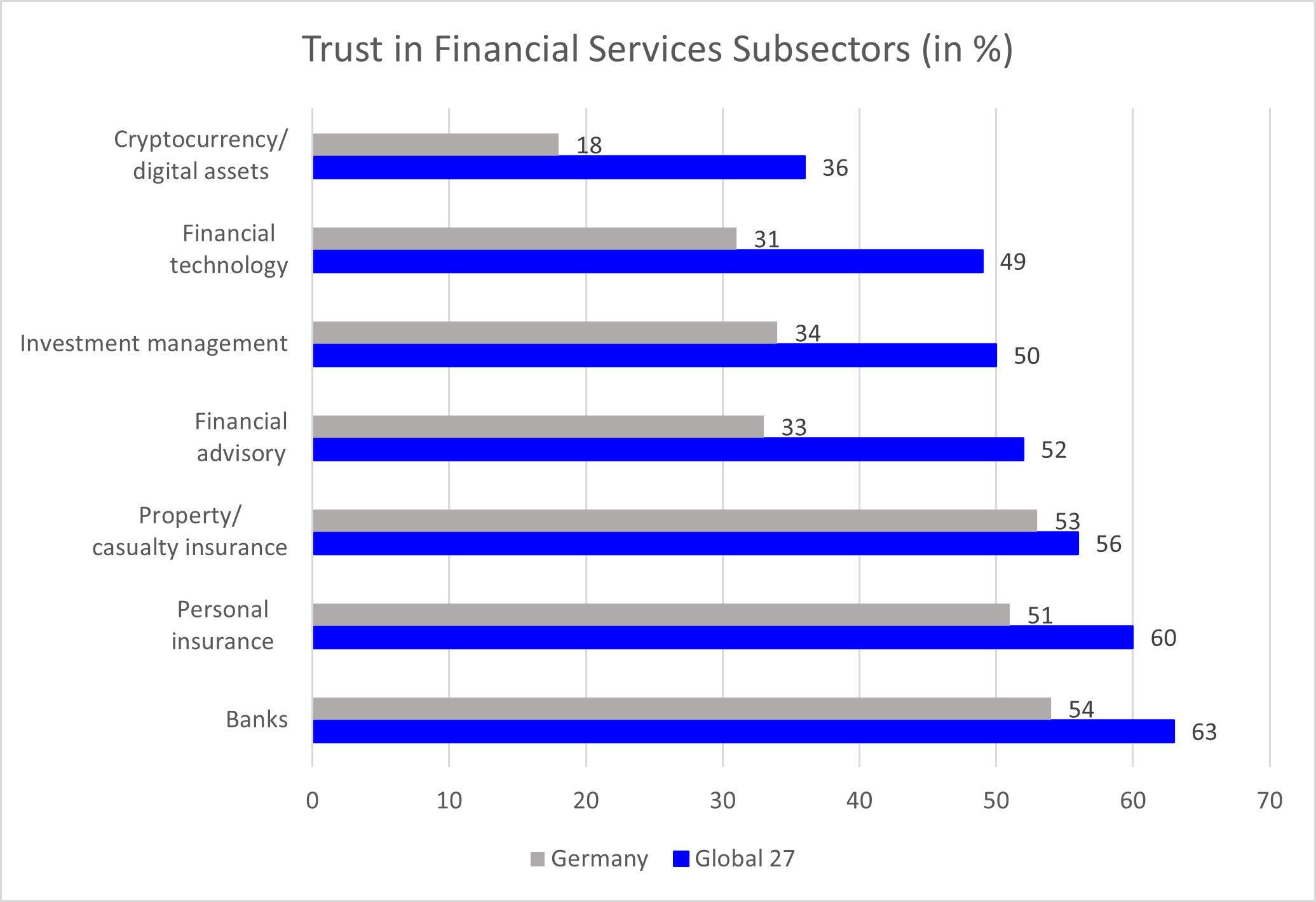

A look at individual sub-sectors of the industry shows that cryptocurrencies and digital assets are deeply mistrusted in Germany. Only 18% of the Germans surveyed trust this sub-sector (the mistrust range is between 1 and 49 percentage points). Also in the distrust range are investment management (34%), financial advisory companies (33%) and fintech companies (31%).

Missing Vision

Companies in the property/casualty insurance (53%), personal insurance (51%) and banking (54%) sectors made it into the neutral range – between 50 and 59 percentage points. The latter has shown an astonishing development in Germany when compared to last year. Banks’ trust score increased by 16 percentage points, indicating that the sector gained significant trust in Germany between 2022 and 2023. This development contrasts with the rest of the countries surveyed, where banks only gained an average of two percentage points. However, at 63%, international respondents as a whole still express a higher level of trust in the banking sector than the respondents from just Germany. The statement, “financial service companies serve the interests of everyone equally and fairly,” only rings true for 27% of Germans. Furthermore, just 32% agreed with the statement, “financial service companies have a vision for the future that I believe in”.

Source: 2023 Edelman Trust Barometer – Insights for Financial Services

General Fear Drives Skepticism

“Overall, the results reveal a fundamental lack of confidence in an important area of our economy,” says Holger Nacken, Managing Director Financial Services at Edelman Smithfield. A further decline in confidence is also to be expected on a global level, he adds. “We saw the implosion of crypto-giant FTX at the end of last year. In the US, bankruptcies of regional banks caught us most off guard. In Switzerland, there was the government-led takeover of Credit Suisse by UBS, which will reshape the asset management business and Swiss banking globally,” says Nacken. In short, the entire sector is back in public discussion.

This sector skepticism is embedded in societal and existential fear. Currently, global respondents fear for both themselves personally (89% of job loss) and for society (76% of climate change, 72% of nuclear war). Fear of inflation is also widespread, at 74% globally. On this particular issue, Germans are somewhat more optimistic at 69%.

The situation is different when it comes to general economic confidence. The statement, “in five years, my family and I will be better off,” is still agreed to by 40% globally (down from 50% last year) – but by only 15% in Germany. Only the Japanese and the French are more pessimistic.

The Path to Higher Trust

How can companies in the financial sector gain trust in this climate of mistrust? “The focus here is on transparency and education, with the company's own staff playing an important role, because there are also positive signals here,” explains Nacken. The question of trust is quite different among employees. Of all the 17 sectors surveyed, employees' trust in their own employer is in fact highest in the financial sector, at 83%. “Here, it makes sense to credibly involve your own employees in communication,” advises Nacken. Building and strengthening trust today is above all a question of transparency, honesty, and preparation. It is not possible to react with the necessary speed in a socially and globally networked world without having well-thought-out strategy and positioning in advance. In the current situation, there is a high sector risk: the problems of individual financial companies have a negative impact on the entire sector. Nacken: “The clearer a financial institution communicates its own corporate values and is publicly understood, the better its chances of surviving such crises and even emerging stronger.”

Press contact

Annalena Schildt

Senior PR- und Marketingmanager Germany

Tel.: +49 (0)172 688 31-41

E-Mail: Presse-DE@edelman.com

Holger Nacken

Managing Director Financial Services

Tel.: +49 (0) 221 828 281-20

Mobile: +49 (0) 172 569 8055

E-Mail: holger.nacken@edelmansmithfield.com

You have interest on Edelman Trust Barometer 2023?